Click here for a printer friendly version of this report

“The Greatest Banking Crisis Since the Great

Depression

is Now Here.”

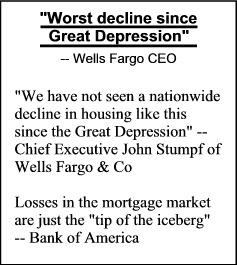

“The sub-prime mortgage crisis is only the tip of the proverbial iceberg. The real estate boom and post-9/11 economic recovery were financed with hundreds of trillions of dollars in debt: highly-leveraged, high-risk derivatives that Warren Buffett calls ‘financial weapons of mass destruction.'

“Trillions in IOUs are coming due. And no one has the money to pay them. The world’s largest financial institutions are losing tens of billions. They will soon be broke. The U.S. dollar is collapsing. You have very little time left to protect your wealth. Even your home is at risk if you don’t take the right steps now.

"Desperate rescue attempts by the Fed and U.S. government give new meaning to the expression 'too little, too late.' $150 billion in happy checks do not come close to covering the multi-trillions in losses. It's like pissing in the ocean to make it yellow.

"Ordinary investors are about to discover their life savings have been invested in worthless junk debts -– derivatives -- that have already wiped out.

"Act fast, and you might be able to save your wealth -- and potentially make more money in the next six months than you’ve made in any other investment in your life.”

-- Nick Guarino

Dear Former Subscriber,

That's right, it's me, your old friend Nick.

You may be surprised to hear from me after all this time. Frankly, I'm surprised I'm writing you.

My attorneys think I'm crazy. "Don't rock the boat," they say. "Play it cool, keep your mouth shut, and do NOT give the people who really run this country another reason to ruin you."

But I have no choice. I believe your wealth -- in fact, your very way of life -- is in mortal jeopardy. The information in my possession could make the difference between you losing everything you have... and multiplying your wealth several times over.

It's been years since you and I talked. That was not by my choice. I was forced to stop writing my labor of love, my life's work of 25 years.

Believe it or not, I was ordered by a court to cease publishing any more newsletters, or risk jail. So much for freedom of the press.

Everyone thought I died or dropped off the face of the earth. Let me tell you: some very powerful people tried to make sure that was exactly what happened.

They damn near succeeded. But I'm back, and just in the nick of time (excuse the pun). With what's going on out there, you sure need to be told what I know.

Whistleblowers are often destroyed.

I was no exception.

When you last heard from me, back in late 2003, everything was going extremely well. My analysis of the markets was right on target. My trading recommendations had never been better. Many subscribers to my premium services told me they were making enormous amounts of money.

Wall Street painted me as a rogue and an outlaw. But my loyal subscribers knew I was giving them analysis and recommendations they couldn’t get anywhere else. If you recall, I predicted...

... Gold would soar from $325 an ounce to above $900. It hit that price on January 15, 2008 at the London Fix. As I write these words, it has topped $930 an ounce. (At the same time I said gold was the bargain of the century, Wall Street called it the "barbaric relic of the past.")

... The dollar would fall to its lowest level in decades. I begged you to buy Euros. Since then Euros have soared over 50% against the dollar;

... The housing market bubble would pop and real estate prices would tumble. Housing values would plunge. I told you to sell every piece of real estate you own, anywhere in the world -- that you would be able to buy it back later for 10¢ on the dollar. Housing prices have fallen faster this year than at any time in history, with the worst yet to come;

... Sub-prime mortgages were a scam that would collapse and wipe out millions. I said people who were practically drooling on the mortgage application were buying $400,000 homes with no money down...and that this was just the start of the bad-mortgage meltdown. I warned you to get completely out of debt. I said the greatest debt orgy the world has ever seen would topple the U.S. financial system.

... The stock market would rally to new highs, and then have its biggest crash ever.

Most important of all, my message was getting out to a much larger audience.

We had launched a successful radio show, Radio Free Wall Street. I was broadcasting on some of the largest radio stations in the country. Including America’s biggest talk radio stations, such as WABC from the heart of Wall Street in New York, and KTLA in Los Angeles.

Millions of people were hearing me each week. They were learning the lies, misinformation and outright fraud being foisted upon average investors -- both by Wall Street and its conniving politicians in the Federal government.

They were hearing a radically contrarian message, that no one else was telling them. I warned them over and over again about the derivatives time bomb that would soon wipe out the U.S. economy. People were loving my message...

Then, out of the clear blue sky, all hell broke loose... and I was running for my life...

The Night of the Iguana

At about 4:15 a.m. on Thursday, January 22, 2004, an associate of mine got a call from a former Israeli commando I knew. Let's call him Moshe.

Moshe used to work in the Shin-Bet, the Israeli internal security police. When he got in touch with us, he was working as a security consultant, a private eye and an agent for the Israeli government.

One of Moshe’s jobs was to track down members of the Russian mafia. He also gained quite a bit of fame when the family of a famous sports hero wife hired him. Moshe investigated suspicions that he was cheating on her.

To this day, I have no idea how Moshe got my associate's private phone number. (A custom-made, scrambled satellite phone untraceable by anyone.) My associate Hurley (not his real name) was stunned by how much Moshe knew about me, our publications and how we operated.

Moshe said he had some urgent information for me. He would arrive in Gibraltar on the 8:00 a.m. flight from Heathrow in London. He wanted to reveal things he could not talk about on the phone.

That gave Hurley just enough time to hop in his car, leave his rented villa near the Valderrama Golf Club, clear the border queue between Spain and Gibraltar, and get to the meeting.

Hurley was scared to death. He arranged to meet at the Rock Hotel, the most public place he could think of.

Moshe told Hurley that after five years, some of my many enemies had finally located my current secret residence. They had the help of powerful friends in the U.S. government.

They used state-of-the-art satellite and NSA spy technologies: the same ones the Feds use to track down al-Qaeda terrorists and Colombian drug kingpins. They found me by triangulating the signal on my Immersat data link. They used other nearby satellites, and a roving earth station in a high-tech van.

(Up till then there was no known way to locate a Thane Satellite earth station. That was why I used it.)

And they were coming for me. I had only a few hours to get away.

I woke up my wife, kids, and members of my household staff. I told them we had 30 minutes to hit the road. My wife was hysterical. We were living on a chartered yacht. We loaded a few suitcases onto the cigarette boat (a large, very fast speedboat) I kept moored near the marina.

My terrified wife and children did what I asked with tears in their eyes. We left everything behind. Fortunately, I had foreseen the possibility of just such a raid. I kept all my important data off-site, inaccessible. Plus, we had a safe house. I knew we had to be there within 24 hours.

With dawn approaching, we cast off and sped away across stormy winter seas to safety. Normally I would never have gone out in that kind of weather. But being a lifelong sailor...spending more time living on boats than on land... and considering the professionals coming for us... I knew we had to take the chance.

Our options were few. I had received threats for years. So I guess I knew this day would eventually come.

Every issue of the WSU exposed more and more scams. Over the years, I made a lot of enemies on Wall Street and in Washington. These are the wealthiest, most powerful men on the planet. They have the money, and the patience, to get what they want. And what they wanted most now was my head.

My wife was terrified. I could tell she was at the breaking point, as she sobbed bitterly. The kids were crying.

I knew that at this time of year, the Bay of Biscay -- which we had to cross -- is home to the Atlantic Ocean’s roughest seas. The swells can easily reach 30 feet, with winds gusting over 50 knots. At any moment, a wave could swamp us. The rocky coastline is littered with shipwrecks dating back to the Romans.

I also knew that if we hit the wrong current, we would not have enough fuel to make it across the bay. Visibility was down to a hundred yards.

The boat was pounding on the waves so hard it made your teeth chatter. I feared her high-tech composite hull couldn't take it much longer. It turned out the bottom was severely damaged and needed extensive repairs.

But luck was with us, and I made our way into the safety of the harbor and dock. From there we loaded everyone into the SUV we had stashed there, to make the fifteen-hour drive to our safe house.

I knew that our lives were at a crossroads.

Gone were the yachts, private jet planes, five-star hotels and mansions. We were in for a much different existence, at least for a while. Now was not the time to sip champagne on the aft deck of a luxury yacht. Now was not the time to go racing down the autobahn in a Ferrari. I wouldn’t be showing up in Monaco for race week any time soon.

It was time to disappear off the radar screen. To wait for what I knew was coming: the tsunami of debt that would soon swamp the entire global economy.

Despite all my successes, I knew I was being pruned back to my roots. Tested to see if I really practiced what I preached. Being prepared for what I had long predicted and what I believe is now, at last, upon us: the greatest economic wipeout since the Great Depression.

I later learned we barely escaped. About an hour after we left, some very determined, very serious men forced their way into my luxurious abode. They ransacked the place. The yacht was completely trashed. They carried off everything of value. Part of their "fee" arrangement.

Equipment was smashed. Wires were cut. Generators and main engines damaged beyond repair. They wanted to make sure the yacht wasn't going anywhere. The crew was bought off or scared off and sent on their way.

We barely got away. But that was just the start of the nightmare. My enemies on Wall Street were determined to put me out of business for good. As often is the case, they used their connections in the Federal government to do their dirty work for them.

Why they needed to silence me

In the months and years before that fateful night, I had started revealing the most deadly Wall Street scandal of all: the leveraged mountain of uncontrolled derivatives debt. I was showing more and more people what these derivatives were -- and how they would eventually wipe out the entire global financial system.

Derivatives are complex, leveraged bundles of junk debt. Incredibly, they often carry AAA ratings. ("AAA" means they are supposedly as safe as U.S. government T-bonds. As you'll see in a bit, that is probably the most costly lie ever to come out of Wall Street.) Wall Street created derivatives to raise enormous amounts of cash out of thin air.

Derivatives are made up of things like options. Sub-prime mortgages. “Mutualized” credit card and automobile debt. Credit SWAPs. And especially the lowest-grade corporate debt known as junk bonds.

In all derivatives, a tiny amount of money controls debt “assets" supposedly worth vastly more. That is why they are called leveraged.

By design, derivatives are incredibly complex. No one outside Wall Street's inner circle can figure out what they really are worth. They are made that way on purpose. Wall Street doesn’t want the suckers to figure out the IOUs they bought are worthless, until it’s too late.

But what no one denies is this: Derivatives have allowed Wall Street to, in effect, create their own private mint. Insiders call it the “Shadow Banking System.”

The Shadow Banking System lets Wall Street create as much money as it wants -- to spend as it chooses -- completely outside the government.

You see, in the past all money creation was controlled by the Federal Reserve. But derivatives changed that.

Derivatives are literally “off the books” creations of the banks. i.e. they do NOT appear on the banks' balance sheets. They are totally unregulated. Only one thing limits how many dollars worth of derivatives are created: the greed of the investment banks.

That is why the entities that create these massive derivative debts are offshore. They are usually based in places like the Cayman Islands. That keeps them out of reach of the banking regulators. They can do whatever deals they want there, in absolute secrecy.

The amount of debt these bankers have created with derivatives is beyond imagining. The Federal Reserve estimates that America's largest banks alone hold $300 trillion worth of these highly-leveraged debts.

In one way or another, almost every bank and financial institution in the world -- including yours -- holds these debt instruments from hell.

$800 TRILLION in derivatives have given Wall Street,

not the Fed, control of the U.S. money supply

The leverage on derivatives is hard to believe. As much as 556 to 1 or more. That is how tens of trillions of dollars in initial derivatives have turned into hundreds of  trillions. Now an estimated $800 trillion worth of derivatives trade every day.

trillions. Now an estimated $800 trillion worth of derivatives trade every day.

This debt and money creation is so huge, Wall Street has taken control of America’s money supply from the Fed. Wall Street investment bankers can now create money at will.

It's simple up till now. They just made another derivative. Then they sold it to an unsuspecting financial institution, who believes the bogus AAA rating and wanted the slightly higher yield. This is why, in 2006, the Federal Reserve took an unprecedented step: they stopped publishing figures for M3 money supply growth. M3 measures TOTAL money supply. That includes money from private (non-governmental) debt instruments. M3 was growing so fast the Fed could no longer allow the public to know the truth.

The more conspiracy minded believe the government didn’t want us to know the enormous debt bubble that was being created. They sure as hell did not want a lunatic like me telling you about it. They didn't want me warning you about the dire consequences.

$800 trillion of derivatives are the Shadow Banking System. It has made Wall Street insiders more money than they dreamed possible. But at a horrible price: the eventual collapse of the U.S. economy...and the wipeout of the U.S. dollar. As Warren Buffett predicted, American citizens will soon become little more than land serfs.

Your bank account has been

thrown into worthless derivatives

Here’s why:

Derivatives trading didn't just stay in the hands of a few Wall Street investment firms. Most of the world's largest financial institutions wanted some of those trillions. They wanted a piece of the action. So they placed nearly all the money they had in the derivatives casino. Including yours.

They took the trillions of dollars in savings that ordinary Americans had trusted them with -- i.e., all the money people put into their banks. Their mutual funds. Their retirement accounts. Their brokerages and mortgage companies. America's savings were placed on the derivatives craps table.

Your bank probably has your money in these derivatives. In all likelihood, so does your money market fund.... your mutual funds.... your retirement account.

Every financial institution the world over has thrown mountains of money into the derivatives casino. Often they did not know what they were buying. They trusted the rating .

But as we speak, $800 trillion of a lot of someones’ life savings are stacked up on the derivatives roulette table.

This vast mountain of borrowed cash –- all based on derivatives -- has kept the entire world economy afloat since 9/11.

Derivatives provided the CASH to fund the real estate bubble and stock market boom...

... the mortgage loans that let people buy houses they couldn’t afford...

... which in turn fuelled massive consumer spending through home equity loans...

... which kept corporate profits alive...

... which funded stock buy-backs and Leveraged Buyouts. This allowed the stock market to keep rallying after the tech wreck, 9/11 and the Enron fiasco.

Derivatives also financed trillions of dollars for hedge funds. Hedge fund traders used that money to bid up oil and gold (and other commodities) to all-time record highs.

It was the ultimate Ponzi scheme. Oil producers loaned a few billion dollars to a hedge fund... which used the incredible leverage of derivatives to turn that into hundreds of billions. Then the hedge fund bought vast amounts of oil (and gold), bidding prices ever higher. Repeat this a hundred times over in a hundred different hedge funds and you get a pretty good idea what has been going on.

But remember, derivatives are DEBT. And eventually, as we all know, debt must be repaid. Eventually, the credit card bill comes due. If you can’t pay it back, you go broke.

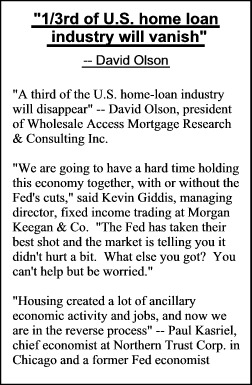

That day has arrived. The biggest, most important banks in America can’t pay back their derivatives debts and can’t issue any more. Neither can the Wall Street investment banks or the biggest brokerage firms. People are starting to figure out the worthless derivatives scam and their phoney baloney AAA rating.

Banks can’t pay back their derivatives debts and neither can millions of Americans, who bought $100,000 homes for $500,000 -- all financed with derivatives money. America is about to take it on the chin.

When you last heard from me, I was warning you about this whole ugly mess. I was telling you that derivatives were a ticking time bomb, a massive debt orgy.

I said HUNDREDS OF TRILLIONS of dollars in debt would soon come due –- and that money could never be paid back. This would destroy the entire global financial system.

Wall Street's biggest scam ever was being exposed by me. Both on the airwaves and in my newsletters. The big money men and Washington politicians could not afford to let this go public. I had to be stopped before too many people heard the truth.

That was when the plug was suddenly pulled and we were put out of business almost overnight...

The Clintons, Whitewater

& Government Harassment

As you may know, throughout the 1980s I owned a commodities brokerage firm headquartered in New York’s World Trade Center. We also had offices in Houston, Texas, and, of all places, Harrison, Arkansas.

At the time, I was considered one of the most successful commodities traders in the world -– and still am in elite circles.

I knew all the big money players in Arkansas. Many, including Bill Clinton and “friends,” wanted to invest with me. I always turned them down. They did not like that. But because of my contacts there, I knew the inside story on Whitewater, the Arkansas banking scandals, even Bill's winning way with the ladies.

In 1987, I got tired of being harassed by regulators, who constantly questioned my track record. Our clients knew my track record was true. Our brokers knew. So did our auditors. So did a independent newsletter analyst from Silver and Gold Report: they checked every trade, and then publicly admitted we were right.

But the regulators refused to accept the astonishing results we had achieved. Even when we gave them documented proof. They made my life hell.

That’s why I decided to close down my brokerage firm, and return investors all of their money. Then I sailed off in my yacht to the Cayman Islands. I decided I would never again be in a regulated business or touch other people’s money.

Five years later, I was shocked when, out of the blue, just as Bill Clinton was making his run for president, I suddenly found myself charged with mail and wire fraud. The charges were not related to my commodities brokerage firm, but to a gold and silver business I had started in 1980 in Arkansas. It had gone out of business when I retired in 1987. The federal government claimed I committed “fraud”: in fact, the business had simply gone under. The State of Arkansas looked at the same facts in 1988 and concluded I had done nothing wrong and closed the case.

But “fraud” is a difficult charge to defend yourself against. That’s why the Feds use it when they can’t find any evidence of real wrongdoing, but still want to go after people they dislike. (Just ask Scooter Libby or Martha Stewart.)

If anything you say, in any public document, can be proven inaccurate or “misleading” -- even if done inadvertently or over insignificant matters -- you’re cooked. In any event, to avoid a protracted battle that could last a decade, I agreed to a plea bargain and served 18 months in federal prison. I now regret that decision. I should have fought the bastards.

To this day, I believe I was railroaded over an unfortunate business failure, put in prison just long enough so I couldn’t tell the world what I knew about the Clintons. The way I say it, Bill went to the White House and I went to the big house.

When I got out in 1993, I wanted to clear my name. And I must admit, I wanted revenge.

I did two things:

(1) I wrote a book titled The Impeached President, that was quoted by such luminaries as Michael Isikoff of Newsweek in his book Uncovering Clinton. I revealed what really happened with Whitewater, the Rose Law Firm, Madison Guaranty and Hillary Clinton’s remarkable ability to make 10,000% profits in cattle futures (with the help of the state´s biggest corporation, Tyson Foods). I exposed Monica Lewinsky, predicted Clinton would be impeached; and

(2) I launched a new financial newsletter, The Wall Street Underground, to reveal the crimes and financial misdeeds of Bill and Hillary Clinton and their cronies on Wall Street. My goal was to show the little guy how he could get ahead and make money. Even while the whole system was stacked against him.

We broke stories the big boys desperately did NOT want told. We explained to ordinary investors how Wall Street really works.

We exposed the dot.com scam. That's where Wall Street tricked ordinary people into putting their retirement nest eggs in worthless dot.com stocks. Stocks Wall Street insiders knew had no profits and could soon go broke.

We named names. Years before federal prosecutors charged them, we predicted just which CEOs and Wall Street brokers would go to prison.

And we did more than that. We showed small investors how to get even. How they could use the same insider trading techniques to potentially make fortunes as gold soared... the U.S. dollar plummeted... and “name brand” stocks wiped out.

Not surprisingly, we were investigated by government regulators almost from the moment we started.

Almost like clockwork, the bureaucrats tried to shut us down. People who did business with us were given secret federal subpoenas. They were ordered to produce boxes of documents, private telephone and bank records, the whole nine yards.

Our computers were seized, our business records scrutinized. Our vendors were threatened if they kept doing business with us. They were warned not to even tell us what the government was up to.

But each time, our lawyers successfully defended our right to publish. For two simple reasons. We were publishers, fully protected (we naively believed) by the First Amendment. And we always followed the letter of the law.

We quickly hired the best attorney in the business: the man who in 1985 won the landmark Supreme Court decision against the government, called the Lowe Decision. (Lowe vs. SEC, 1985.)

Lowe affirmed the right of financial publishers, like us, to give our opinions about the market and specific trade recommendations -- without censorship from the government.

With one caveat. We could only give impersonal financial advice. We couldn't give recommendations to individuals based on their specific situation. That would make us a broker.

My publisher was so concerned, that every issue of our publication, every advertisement, every posting on the website ran through our legal team. He wanted to make sure we obeyed the letter of the law.

The lawyers assured us over and over again that we were lily-white clean. We put in legal disclaimers... revealed my “criminal” past... told subscribers to never trade with more than you can afford to lose and never with more than 10% of your liquid net assets.

Most important of all: We NEVER touched anyone’s money, never gave personal advice. Time and again our lawyers affirmed our rights to publish. Both to the regulators and to our publisher.

WSU was a great success. It was my life’s work. I loved every word of every issue. The regulators constantly tried to deny us our right to publish. But our attorneys always quickly backed them down. Simply by proving that we complied with the law.

Still, as we took on Wall Street, the harassment got worse. We reported major scandal after scandal. With 150,000 subscribers, we became the largest financial newsletter in the business.

Our trade recommendations could swing markets. They were picked up and disseminated by lots of wannabes. And we had a fair share of trading successes. Many subscribers wrote to tell us of the huge profits they made.

The bigger we got -- the more successful our trading recos -- the more Wall Street and the regulators attacked.

In 1998, we were the first financial newsletter to publish on the Internet. We were the first premium publication on the web. That let us deliver massive amounts of info to subscribers, nearly instantly.

It was so new, many people didn't have computers or high-speed Internet connections. So we offered an Internet-ready computer to all subscribers as a free bonus. We also arranged a high-speed data line, free of charge.

Another disaster. The company that provided the computers scammed us. They weren't able to connect to the Internet. Of course they refused to honor their guarantee. So we bought a second computer for subscribers who received faulty computers. That was the price of innovating.

Despite all this, we kept growing. Wall Street did not like it. They felt THEY were the only ones who should give trading recommendations.

They especially thought only they should make real money. They did not like anyone revealing their schemes. They hated it that we were telling people to sell stocks, not buy. And they hated it even more when they saw small investors making enormous profits off of their secret scams.

Our website hosting company was threatened. Under pressure, they demanded we move our website. We tried to find out what was going on. They wouldn't tell us. That's when we learned that we had to have multiple secure servers, in diverse locations. We were making quite a stink in the markets. Our enemies wanted us silenced.

One thing we did was to locate our primary servers in a brand new country called Sealand. Sealand was located on an old offshore platform. By international law it was agreed to be outside the jurisdiction of any country. The "King and Queen" of Sealand liked the idea of doing web-hosting, so long as the sites they hosted had no gambling or pornography. That worked well. Until mysteriously Sealand caught on fire and was destroyed.

We were under constant attack. We knew we had to have backup fulfillment centers. Backup servers. Backup everything.

One day a fulfillment center we had used from the start called us. They said they would no longer work for us. They just stopped answering the phones. We were shocked. It took months to get the phones switched and all our records transferred. You can imagine the ill will created with subscribers who were caught in the middle.

We found out later that the government had threatened them. Terrified, they stopped doing business with us. But in the most business-disruptive way possible. We learned you needed to back up your backup, and you could not be too secretive.

The remaining founding investors wanted out. I was too radical. Too hard to deal with. The constant investigations and threats were wearing on them.

A long-term friend of mine and lifelong resident of the Cayman Islands agreed to buy the publications. We will call him Roderick.

Roderick was perfect. He knew my past trading successes. He had accounting experience. A non-American who lived outside the U.S. An international businessman who had worked with some of the wealthiest people in the world, in the ocean shipping business.

Roderick was the key for turning the WSU into an international publication. Now many financial publications do the same. Hedge funds, traders and financial analysts are often no longer based in the U.S.

From the time the publication became international, it really started to grow. It was a great association. He handled the business and I did the writing and editing.

A few years after Roderick bought WSU, it had doubled in size. We had an audience in the hundreds of thousands. Even worse for Wall Street, we were now on radio stations across the country. We were telling millions across the nation about the coming collapse of the banking industry... explaining what “derivatives” are... telling ordinary people how they could turn the tables on Wall Street.

I was screaming that derivatives would take down the entire U.S. economy and global financial system. Wall Street could not afford to let me do this. They stood to lose trillions of dollars.

Too much was at stake. We had

to be stopped. The kid gloves came off.

Up until this time, the government had failed in all its legal actions against us. But when I began revealing the derivative scheme -- Wall Street's biggest, most profitable scam ever -- all that changed.

It was them or me. The smear campaign and dirty tricks started in earnest. You know, the Federal government is the biggest debtor of all. They need Wall Street to keep financing their deficits. You can imagine what happened.

In 2003, the Commodities Futures Trading Commission (CFTC) -- the federal government agency that regulates the futures industry -- took advantage of the post-9/11 paranoia and the draconian Big Brother police powers that came in its wake.

The Feds came down on us like a ton of bricks.

CFTC regulators insisted we were not publishers, like other financial newsletters or the Wall Street Journal. We were NOT protected by the First Amendment. No, the CFTC said, other financial newsletters and newspapers were exempt from its broker regulations...but we were not.

According to the CFTC, we were unregistered "commodity trade advisors" -- even though we followed all the CFTC's regulations for what they called exempt publishers...never touched a penny of subscribers’ investment money... and never, ever, EVER gave personalized advice.

In other words, the CFTC claimed we were subject to the same rules as futures brokers and, thus, under the CFTC’s jurisdiction.

What’s more, the CFTC said the famous Lowe decision -- which did not allow government to censor or regulate financial publications -- didn’t apply to them.

Our lawyers consider this the most outrageous assault on the First Amendment they’ve ever seen. They are certain it will be overturned some day by the U.S. Supreme Court. Just a few millions dollars in attorneys fees...five or ten years of litigation...and the whole matter will be cleared up, my attorneys said.

There is just one problem. None of us has that much time.

CFTC agents raided our contractor's office in Kansas. Computers were impounded. Our bank accounts were frozen. They threatened and intimidated employees of our independent contractors, who did printing and customer service. It got ugly.

Roderick, the organizational genius behind us becoming an international publication, sold out and bailed out. He paid a fifty thousand dollar fine, took his millions in profits, and retired.

Then the Feds detonated a nuclear bomb on us. They got a lone judge to issue what’s called a Mareva injunction against us. Normally they reserve this solely for drug cartels and terrorists.

Without a trial or even an independent investigation, this allowed the Feds to freeze all our assets anywhere in the world -- and actually prohibit us from publishing altogether! Yes, I was prohibited by court order from writing. Under threat of prison I could not publish one single word.

It’s hell when your life’s dream becomes a nightmare

One day we were exposing Wall Street scams, showing subscribers how to make fortunes. The next we were ordered to cease publication altogether, or face a contempt of court citation and jail.

I could not publish or speak to my closest friends about futures, the markets or the economy. It was the most outrageous gag order ever issued. So much for the First Amendment!

There was no finding of wrongdoing. No trial. No independent investigation.

Instead, the CFTC met secretly with the judge. We were not even there: they made their wild accusations "in camera," that is, in private. With no defense from us, the judge accepted the charges at face value.

Our bank accounts were seized. Every single account of ours was frozen. All credit card corporate accounts shut down.

They cut off funds we needed to pay the attorneys. No money, no defense. An attorney told me, "my clients are 100% innocent until proven broke." Well, we were definitely proven broke, up the creek without a paddle.

The Feds threatened radio stations that carried our weekly show “Radio Free Wall Street.” Though we had a huge, growing following, the stations had no choice. We were cancelled.

They put pressures on our printers. Our service companies. Our fulfilment houses and Internet hosting servers. All were warned to stop working with us. Everyone that had anything to do with us was threatened and scared. Many did and said whatever they needed, to protect themselves.

I can’t blame them. They had families and mouths to feed. It was sad to watch business relationships established for decades come to an abrupt halt. Many had promised us that "we are with you all the way no matter what." When the shit hit the fan they ran for cover.

We were unable to pay our bills, prohibited from publishing. The end!

I was devastated. Up to that time, I had faith in our legal system. I guess you could say I am now over my naïve stage. I hope you get over yours real soon, and it does not cost you as much as it cost me.

Imagine waking up one day and all your accounts are frozen. Your credit and debit cards are turned off. Your business is closed. You are prohibited from publishing or talking about the markets in any way, shape or form. Your publisher cannot even cash a check, never mind write one.

All this is done in secret. You are not guilty of any crime. But you are unable to meet your accusers or rebut their allegations. (We never even made it to court.) By freezing everyone's bank accounts, shutting down your business, the Feds make sure you cannot pay your attorneys. Bank accounts you have for years are closed. Nobody will open a new one for you.

Almost overnight, we went from being the biggest financial newsletter in the world to zero. Nothing.

I was humiliated and destroyed. I lost most everyone and everything. Even my wife left me!

The Government confiscated millions of dollars. Former friends, partners and associates put as much distance as they could between us. Everyone associated with us was scared to death. I was guilty...of telling the truth.

The bureaucrats under Wall Street's thumb were interested in one thing and one thing only. By hook or by crook, they wanted me silenced. They said they would drop all action if I agreed to stop writing and publishing.

I flat out refused! I could no more stop writing, analysing and commenting on the markets and the economy than Einstein could stop doing math.

I was sure that sooner or later the gag order would be lifted. I was not about to give up my constitutional rights to publish, in the interests of expediency and money.

How We Survived

It was a nightmare. But we lived on. For awhile, friends helped us pay legal bills and survive. But the millions they gave us were not enough.

For years I had preached the need to have diversified accounts. I urged you to keep greenbacks stuffed in your mattress. To have hidden hoards of gold and gold coins.

Without all that, I would not have been able to survive these past four years.

I am partly to blame for all this. After two attempts on my life...after serving 18 months in prison as a result of bogus charges brought by the Clinton Administration.. ..after having made enemies of the most powerful men in the U.S. government and Wall Street...I naturally led a very James Bond existence outside the U.S. No one knew where I lived.

Everything I did required secrecy. This doesn’t always make for a smooth business operation. We called ourselves the Wall Street Underground. That is precisely what we were.

The good news is that the injunction was finally lifted. Case closed.

WSU was put out of business by then. I faced huge fines. I look at it this way. The cost for me to talk to you again is over $10 million. It’s well worth it if I can show you how to save your life savings from the biggest wipeout ever -- and just maybe show you how to make millions in the process.

Listen: I realize I’m no angel. I started out my professional life as a commodities trader. We’re not choir boys. Commodity traders buy and sell billions on a daily basis. I’ve made mistakes in my life.

But let me tell you: Precisely because of the circles I move in... the contacts I have... the billion-dollar deals I’ve seen... I know how the financial world really works from the INSIDE.

I know how crooked they are. I told you for years that the markets are rigged, and that we know how they are rigged. Millions of former homeowners are learning (at great cost) how right I was.

That’s why I’m the only person alive who can show you how to turn the tables on the Wall Street bastards -- and is willing to do so. Before they reduce you to mere land surfs, as Warren Buffet put it.

And that is why I’ve decided to risk my life once again and come out of hiding. My case with the CFTC is now closed. I am now “allowed” to publish again, if I do not make any futures or futures-option related recommendations.

Which is fine for you and me. These days, the futures markets have been supplanted by other, even better ways to trade. You get fantastic leverage -- so you can make tons of money -- with tiny, completely limited risk.

Sub-prime wipeout is just the

start of the real crisis

Folks, everything I was predicting three years ago is now coming to pass. We’re on the verge of financial Armageddon.

What you've heard about the present financial crisis is just the tiny tip of the iceberg. It is far, far worse than merely a sub-prime mortgage crisis.

Every financial institution in the country is at risk. Many are already technically broke. Derivatives have wiped them out. That is why they are desperately letting foreign investors give them billions of dollars. It's the only way they can shore up their capital.

Our biggest financial institutions -- that hold the IOU’s of damn near everyone in America -- are quietly being taken over by the Chinese Communist government and the Arab oil cartels. Do you really think they have any other ideas in mind than making Americans their economic slaves, modern-day share croppers?

Again I remind you of Warren Buffet's warning: Americans are becoming land surfs.

They have a plan. If you have any savings or investments, you are vulnerable. Their plan is to take your money, and make it their money. To take your assets and make them their assets. To take their losses, and make them your losses. To take your life savings, and in its place put worthless derivatives.

Make no mistake: the collapse of the U.S. mortgage industry and housing market is just the start. The entire global banking system sits on the same derivatives house of cards. It is about to topple over.

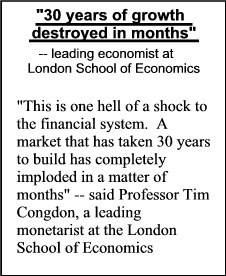

HUNDREDS OF TRILLIONS of dollars will be wiped out. It’s going to be the Great Depression, “tech wreck” and Enron fiasco all rolled up into one -- times TEN!

I know you have seen the stories about the billions of dollars in losses the biggest financial institutions have recently taken. I know you have seen the bailouts... the Fed's panicked rate cuts...the meltdown in the stock and housing markets. This is just the leading edge of a tsunami wipeout.

The U.S. dollar is not plummeting to new lows by accident. Insiders in Beijing, Berlin and London are bailing out of U.S. dollars. They are taking hundreds of billions of dollars, that are at risk from derivatives, out of the U.S. financial system.

They are drooling at the opportunity to buy America’s assets at 10 cents on the dollar. In fact, they have already started. They are quietly taking over our biggest banks and brokerage firms. All at fire sale prices.

The big-money people know what’s coming. They’re getting out of derivatives and derivatives-backed assets.

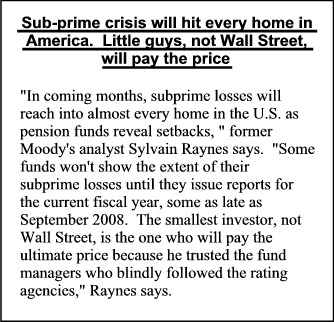

As usual, the little guy will get stuck with the bill. The average American investor is going to be the big loser.

As we speak, Wall Street bankers are handing off these worthless derivatives to you. They are stuffing them in your money market accounts. Your retirement accounts. Your brokerage account and your bank.

The billionaires will make more billions. Why do you think Warren Buffett has been selling U.S. dollars for years?

The typical American worker will see his life savings wiped out. He will lose his home, his new car, his job, his retirement accounts and everything he has worked for.

Why you could make millions

in this derivatives wipeout

Folks, more money is about to change hands than in the history of the world. That ain't no joke and it ain't no maybe.

And I don’t mean in just in one or two markets. You could potentially make a fortune in a dozen different investments at the same time.

Why? In part because markets fall a whole lot faster than they go up. And we are in extraordinary times. Usually wipeouts are isolated events, limited to some regional real estate markets or financial sectors. Not this time. $800 trillion of derivatives are wiping out this very moment. They have put the entire world economy at risk.

this very moment. They have put the entire world economy at risk.

Also, with all due modesty, I am an acknowledged master at trading falling markets.

For example, I know some new investment instruments that were created in the past few years. They could well make insiders MILLIONS as real estate continues to collapse.

Wall Street invented these investments. They want to make sure they keep making tons of money when the markets tank. That is already happening. Wall Street insiders are paying themselves multi-billions, while their clients take a beating.

I will show you how you can get these same instruments, and maybe make a fortune yourself. Only $800 trillion is up for grabs. Who knows, there could be a billion or two laying around for you and me.

Crashing home prices can make you poorer –

or they can make you rich

Take home foreclosures. They are already at record highs. But don't be fooled. What we’ve seen so far is only the beginning. The worst is yet to come.

If you want to know how far prices will fall, look at real estate values in 2006 and early 2007. Then subtract 90% of their value. That is where I believe you will soon be able to pick up properties.

In other words, a million-dollar home in 2006 will easily be bought for $100,000. Maximum. The more expensive the properties, the bigger the bargains. You could see some top-of-the line properties lose 95% of their value before the fat lady sings.

That means you could make a fortune, trading the right instruments, as real estate continues to plunge in value.

No need to buy or sell properties to

cash in as they wipe out.

New trading vehicles let you make money as every foreclosed home brings prices down. The more home prices fall, the more you could potentially make.

You don't have to buy or sell a single property. You don't trade futures or options on futures.

One hedge fund made $20 billion in 2007 with this new instrument -- on a $2 billion investment! 1000% profits. And remember, the vast bulk of foreclosures have yet to hit the market. That's when the real profits in this investment kick in.

Wall Street does not want you to know about gems like this. They are supposed to be for Wall Street insiders only. But these instruments trade on the public markets. You could earn huge profits with little money upfront. Risk on the downside is easily managed.

And there are other great opportunities you can take advantage of. In fact, in just the past few weeks, four of my current specific reco's could have made you a fortune. That is just the beginning. The real money should be made in the weeks and months to come. Let me tell you what they are, and how you could get rich with them...

- Gold. The whole world believes gold will jump in value. The thinking goes, with the Fed lowering rates, we'll get inflation. Just like in 1980, they are in for the shock of their lives.

The gold market has been driven by one thing: incredible amounts of leveraged money from derivatives. That money was given to hedge funds, to buy gold. But derivatives are wiping out. Hedge funds don't have any more money. And with the stock market in a nuclear reactor meltdown, their funding is drying up.

What's more, we're in a recession. As more people lose their jobs and homes, prices go down, not up. There is no more cash: derivatives used to finance housing are wiping out.

Contrary to Wall Street myth, Asian demand for gold is NOT soaring. They can't afford it on their $1 an hour jobs. And higher gold prices are KILLING demand. 70% of all mined gold goes for jewelry. Today's prices are just plain too high. Especially with the consumer getting savaged by this recession.

We had the greatest rally ever in stocks and the housing markets. Gold went up with them. Now stocks have peaked and are crashing. So is real estate. Gold will do the same.

I expect gold to fall and fall hard. We're not talking about futures trades. There are much better ways you can do this.

They are called ETF's. Exchange Traded Funds. Hedge funds made massive amounts of money with them. Now it's our turn.

ETF's trade like stocks. One share is equivalent to 1/10th ounce of gold. They trade under the symbol GLD. You can sell shares of the ETF. You can also sell options on the ETF's, that give you outstanding leverage.

How much could you make? With $10,000 invested in ETF options, a $100 drop in gold could make you $50,000. A $200 drop in gold (that only takes gold back to where it was trading last September), could make you $100,000. Bigger drops could make you far more.

At the same time, you limit your losses to the small option price. You get nearly unlimited upside -- with tiny, strictly limited downside. The best of both worlds.

Remember, when gold was $270 an ounce, and Wall Street called it "the barbaric relic of the past," I told you it was the bargain of the century. I begged you to scoop up all you could, with both hands.

Now I'm telling you gold has gone way too high, and must come crashing down. Yet Wall Street wants you to buy at record highs!

As always, Wall Street wants you to sell on the lows, and buy on the highs. I think it works better if you buy on the lows and sell on the highs.

2. Conservative trade with speculative profit potential. Here is a conservative trade...guaranteed by the U.S. government...that could make you 200% profits in the next 12 months.

Every time the Fed lowers interest rates, you make money with this trade. If rates stay the same, you don't lose a penny. And the investment itself is completely guaranteed by the U.S. government. Here is how it works.

The U.S. Treasury issues an instrument called the Zero-Coupon Bond. This bond increases in value as interest rates fall. The more rates fall, the more you make.

One nice feature of this bond is that the upside is four times greater than the downside. i.e. you make four times as much if rates fall by one point, compared to what you lose if they rise by one point.

But the chances of rates going up are somewhere between slim and none in my opinion. The Fed is in crisis. They have to keep lowering rates, back down to the 1% range they were at before this mess started. Maybe even lower. I expect Fed Funds rate to drop to 0.5%. I believe the 20 year zero coupon bond will drop by 3 points.

By following the simple trading strategy I will give you, you could make 200% profits. Not bad from a conservative investment, guaranteed by the U.S. government, whose downside risk is next to zero.

- Oil. Another great market, that offers unprecedented opportunities.

Oil prices soared on nothing short of insanity. Hedge funds got unlimited money from highly leveraged derivatives loans. Then they bought the shit out of oil. Things got so bizarre, hedge funds bought oil storage facilities. They had to. It was the only way they could park the huge volume of oil they were forced to buy, to keep prices sky-high.

Now the perfect storm is forming in the oil market. First and foremost, oil supplies are soaring. Everyone wants to get in on this sky-high oil price bonanza. The most money in history has been spent on bringing new oil production to market. The oil is coming in. The market is getting swamped with new oil.

Second, hedge funds are running out of money, due to the derivative wipeout and their bad trades in stocks. Their source of money to keep the insanity going is drying up. The biggest force in the oil market, that drove prices to over $100 a barrel, is going broke.

And now the one thing no one wanted is hitting the market: the crumbling global economy. This is killing demand for oil. High prices, the derivatives wipeout and the spreading global recession have destroyed demand.

At the exact same time, oil supplies have skyrocketed. Soaring supplies and falling demand mean one thing. Prices will come crashing down.

There is a fantastic way to trade oil. An ETF that trades on the American Stock Exchange. Symbol USO. You can also trade an option on this ETF. You strictly limit risk, to the low cost of your option. Yet you get up to 30 to 1 leverage.

How much can you make? I believe this ETF could easly fall $20 or more. You could make hundreds of thousands of dollars, on a $10,000 starting investment. Your loss is strictly limited to your modest initial investment.

- The stock market. I saved the best for last. This one has me drooling. We had the biggest stock market bubble in history. Now it is starting to crack. Please believe me when I tell you the truly big moves are yet to come.

Every major financial institution in America is facing wipeout. The biggest banks and brokerage firms are getting killed as we speak. They are borrowing so much money from Arabs, they will soon have to follow Sharia law and close down for Muslim holidays. Sales in industry after industry are collapsing. The global economy is in a major slow down.

And the biggest companies -- the petroleum companies -- will be in a major crunch as oil collapses.

The main investment most people hold is their home. It is wiping out. Home equity loans kept consumer spending up. Not any more. The retail spending orgy is over. The U.S. economy is in big trouble.

The stock market is due to come crashing down. How much? A few months ago the Dow traded at 14,200. Now it's fighting to get back to 13,000. I expect the Dow to fall to 7000 in the next 12 months. Over the next few years, it could fall as low as 2000. Huge plunges are in line on the near horizon.

You can make a fortune, get great leverage, and completely limit your risk, by trading stock market ETF options. Again, no futures. No margin calls. Very small, completely limited downside.

My favorite ETF's are the SPDRs. They trade on AMEX. There are six in all. Each represents a different sector of the market. They let us pinpoint which parts of the stock market will get hit the hardest.

One SPDR is Consumer Discretionary Spending -– i.e. spending on non-essentials. Consumer Staples Select sector is another. So is Financial Select Sector. Others are the Health Care Select Sector...Industrial Select Sector...Energy Select Sector.

One of my favorites is the energy sector. I think you could make a fortune here in the next several months. For the simple reason that I think energy prices are going to come down. That means stocks of energy companies will plunge like never before. Global demand for oil will sink, along with oil prices, in the coming global recession.

I also like Consumer Discretionary. In a recession people have less money to blow. Another great ETF to trade.

Many stocks in the financial sector have already dropped a lot. But still more institutions will wipe out due to their derivatives exposure and slowing economy. I expect us to do quite well with this ETF.

Industrial sector: another real good one. Industrials will get hit hard in a slowdown. And I expect this recession to be the biggest one in 70 years.

Profit potential: if the Dow falls 4000 points, $10,000 could turn into $300,000. Depending on the sector. Since I expect the Dow to drop more than that, the potential profits could be much bigger.

Wall Street Insiders: our new publication, dedicated

to helping you get rich in the derivatives wipeout

The new newsletter I edit is titled "Wall Street Insiders." It gives you a real chance to turn the derivatives wipeout into a fortune.

WSI comes to you on the Internet, and takes advantage of state-of-the-art technology. You get all my analysis on the economy. Every specific recommendation I think can make you a lot of money.

Some of my analysis comes in audio files. You can listen to them on the website...or you can download them as MP3 files, and play them when you wish.

Nick's Picks: you also get every recommendation in writing. "Nick's Pick's" gives you my “generalized non- personalized investment advice,” in full detail. You get entry points... the specific instruments... a discussion of risks and potential rewards. When it's time to take profits, I let you know at once.

The really good part is none of our recommendations are in the futures markets. You have no futures ugly margin calls. Your risk is tiny, completely limited in options on very sophisticated new trading instruments. These reco's let you sleep at night. At the same time, they give you great leverage. You could make huge profits, with little initial investment.

Some markets I cover for you are precious metals, like gold, silver and platinum. These markets are doing moon shots. They cannot sustain these unbelievable prices. In a recession like the one we are having prices go down not up

You also get reco's in the important industrial metals, that are trading at or near record highs: copper, nickel, lead and zinc. Wall Street spin is that supplies are running out. Total b.s.

They forget to mention that hedge funds drove these markets sky-high. (Entirely financed by derivatives.) They don't dare liquidate: they would collapse the markets. And now the global economy is sucking shut. So what little real demand was out there is disappearing. Fantastic opportunities for us.

In WSI we follow the world's hottest bubble commodity: crude oil. I give you extensive recommendations in crude. Also its by-products, like gasoline, heating oil and natural gas.

For 100 years, the crude industry has told the world we are running out of oil. But we never run out. In fact we have had all the oil we could possibly want.

Oil prices have collapsed three times, after these fake shortages. Ironically in the drop in demand recessions sky high oil prices help create. We are on the verge of the fourth collapse, as we speak.

It's been a long time coming. The consumer economies of the U.S. and Europe are about to fall into the biggest recession in 70 years. Global demand will shut down. This myth that the factory workers in India and China will pick up the slack is a fairy tale. These people make $1 an hour. They will see a massive slow down when the export customers shut down spending. Oil is going to collapse big-time. OPEC will take an enormous hit. You could get rich.

I also give you some great trade ideas in U.S. government bonds and foreign currencies. Year after year, these reco's of mine have done really well. With the derivatives wipeout, I expect them to perform even better.

I cover a dozen or more special markets in all: the ones that should make the most money for you in this recession and derivatives meltdown. Some have already started to crack apart.

WSI is constantly updated each day. So you get my hottest recommendations, literally within seconds. When something critical comes up, that you need to act on at once, I send you an emergency email.

A one-year subscription is $5000. No discounts. If you can’t write a check for $5K and not even think about it, you have NO BUSINESS subscribing. This is for people who want to learn how they could turn the coming collapses into big money.

I have correctly warned about market wipeouts many times in the past. But this time, far more money is at stake. Over a hundred times more dollars. I think this derivatives wipeout could be our biggest winner, by far.

And you get more in WSI. Tragically, most people are about to lose everything. Their bank accounts. Their money market funds. Their retirement accounts and pensions. Even their homes.

In WSI you will learn how to keep your assets safe and sound. There are still a few places to put your money, that are guaranteed secure. I will show you what they are and how you can take advantage of them. This alone could be worth many times the subscription.

It's our turn to make a fortune

I'm not going to b.s. you. For me this is not simply about making money. Not even about making a hell of a lot of money.

The bastards pushed things too far. Now I'm pissed. I am roaring mad. I am spitting fire. I am a predator and I smell blood.

They hurt me bad. They tried to ruin me for being right and telling the truth. But you know what? I survived. I am coming back bigger and better than ever.

What really makes me mad is what they are doing to our nation.

They are wiping out the little guys. These people are not as fortunate as I am. They don't have the knowledge or the experience to bounce back. They don’t have a clue about what they must do to protect themselves. Warren Buffet is right: they will become land surfs. They don’t know how to turn the tables on these "financial weapons of mass destruction." But we do, my friends.

Many of your friends and relatives are in that position. They are going to lose their homes. Their savings. Everything they spent their lives working for.

That makes me sick. No one can stop this -- it's too late for that. But there is something you and I can do. We can get back at the Wall Street investment whores. We can become the big winners, as their trillion-dollar scams blow up in their faces. We can get rich in the process.

I know what's coming. I know how to make massive profits from it. Nothing is going to stop me. You can be there, too. I know deep down inside you see what is coming. I know you feel it in your bones.

Join with me. I am putting together a small army of little guys, enlightened people to turn this curse into a blessing. Wall Street wants to wipe us out. To hell with that! Let's make tons of money, on every sleazy Wall Street derivative wipeout. Let's get wealthy, as the big investment banks go under, and must borrow billions more from the Arabs and Chinese communists.

Remember how much money we made in 2000, 2001, 2002 and 2003? You ain't seen nothing yet. The wipeouts of the world's biggest banks and brokers are just the warm-up to the main event.

It is our turn at the switch. Our turn to cash in. Everything we planned and predicted years ago is finally taking place.

There's more money than dirt to be made if you know what you are doing. I damn well intend to make a fortune. It will be a tragedy if you are not there with me.

One key thing you need to know. This is the last hurrah. Now is the time, that is why you are hearing from me again. I believe the recession will end in a global depression. After this massive liquidation of debt, many markets will shut down, and never open again. Trading will be dead for decades. Just like in the 1930’s and the 1970’s.

You have to be there now. You can't wait for things to shake out. Either you're there ahead of time, or you are not there at all. You miss out. It's now or never!

No wonder Wall Street tried to stop us. But guess what -- they failed. We're back. And we aren't just here to get even. We're here to get ahead. Way, way ahead.

Call me Toll Free at 1-866-924-0607 so we can get at these markets again.

Sincerely,

Nick Guarino

---------------EMERGENCY SIGN-UP CERTIFICATE----------

For fastest service, Call Toll Free 1-866-924-0607.

Nick, what can I tell you? I'm blown away. What a story. I knew something was very wrong. I figured you were headed for trouble, when I read the stories you were writing, and saw the news. And then when you were showing everyone how to make money from Wall Street's wipeouts, I knew it was just a matter of time before they got to you.

I am so glad to hear from you again. I thought of you often over these years. Especially lately, as real estate has blown apart...the biggest banks are going broke...gold soared to record highs...and stocks started to fall. Just like you said they would, years ago.

So, hell yes, sign me up! I'm ready. I know what these bastards are up to. I'm watching the big banks and funds lose billions, and realize that's just the start. I'm all for getting rich. Let's make a ton of money. And get even with them the best way of all: by living well...very well indeed.

Send me everything I need to get in on the trades you mentioned: (1) The ETF options on gold that could potentially turn every $10,000 into $100,000 or more; (2) The conservative zero-coupon bond trade that could make profits of 200% or more; (3) The ETF oil options that offer up to 30 to 1 leverage, in which I could make enormous profits for every $1 drop in the price of crude; (4) The SPDR options on the stock market sectors that could potentially make $300,000 on every $10,000 investment if the Dow drops back down to 7,000; (5) Dozens of super-conservative personal wealth pr otective strategies to preserve my money and assets, during what will turn out to be the worst financial disaster in history.

otective strategies to preserve my money and assets, during what will turn out to be the worst financial disaster in history.

Please RUSH me initial trading instructions... access information to your encrypted web site... and sign me up for all email alerts.

[ ] 1 year, $5000

[ ] 2 years, $7500...2nd year half off: BEST VALUE!

To Get Started Today:

Click the GeoTrust button for secure encrypted (SSL) Online credit card orders |

|

|||

| or | ||||

| Call USA Toll Free : | 1-866-924-0607 | |||

| Call Outside USA : | 1-913-871-0701 | |||

Office Open 9 AM to 5 PM New York Time |

||||

Wall Street Insiders * Tel. 1-866-924-0607. * Email to: wsifnsupport@gmail.com

** Disclosure and Disclaimers: We have no conflicts to report on any of the markets we described here. Trading is always a risky business, never trade with money you can’t afford to lose. Click on the link to see a copy of our Disclosures and Disclaimers document

Notice: The story you have read above is true. In some cases the names, dates and/or places were changed to protect people’s identity.